They Said They Had Capital. They Didn't.

Every founder who's raised capital or explored a sale has heard it: 'We have capital, and we're interested in doing a deal.' Here's the harsh truth — most of the people who say this don't actually have money. They're intermediaries, capital-light sponsors, or 'maybe someday' funds. If you're not careful, they'll waste six months of your time and energy chasing a deal that was never real.

They Said They Had Capital. They Didn't.

Every founder who's raised capital or explored a sale has heard it: "We have capital, and we're interested in doing a deal."

Here's the harsh truth — most of the people who say this don't actually have money. They're intermediaries, capital-light sponsors, or "maybe someday" funds. If you're not careful, they'll waste six months of your time and energy chasing a deal that was never real. And in today's market, six months can mean missed growth, a distracted team, or competitors pulling ahead.

The Problem

In the lower middle market — companies with $10–100M in revenue and $2–10M in EBITDA — this problem is rampant. These businesses sit in an awkward middle ground:

- Too large for friends-and-family money or angel investors

- Too small to attract the full attention of top-tier investment banks or mega-funds

- Too important to their founders, employees, and customers to risk being taken advantage of

As a result, they're often left to fend for themselves. Founders hear from an endless stream of "interested buyers" and "capital partners," but don't have the internal resources or external advisors to separate the real from the fake. The market is full of noise, and it's the business owner who pays the price in wasted time, lost momentum, and missed opportunities.

This gap is exactly why CIS exists. The increased interest in these smaller companies is why CIS brings top-tier advisory and investor discipline down to the lower middle market. We've sat on all sides of the table — as operators, investors, and advisors — and we've seen how much value is destroyed when companies chase the wrong counterparties.

The truth is, this segment deserves the same level of rigor, preparation, and access that billion-dollar companies get. Without it, founders end up in conversations with people who talk like buyers but don't actually have capital.

Take the health & wellness CEO I spoke with recently. She spent nearly a year engaged with a group who promised access to deep-pocketed investors. They showed up polished, name-dropped credible firms, and asked for full financials to "kick off diligence." Not once did they write a check. Instead, they ran pseudo-diligence, asked for endless data pulls, and ultimately disappeared.

By the time it ended, the CEO had lost ground with customers, morale in the leadership team had eroded, and momentum in the market had shifted to a competitor. The opportunity cost was enormous.

This story isn't unique — it's the rule, not the exception.

Why It Happens

There are three main culprits:

1. Brokers in Disguise

They don't actually have capital; they're hoping to find it after they tie you up with exclusivity. If they can't raise the funds, you've lost precious time.

2. Under-Capitalized "Funds"

They have a slick pitch deck, maybe even a few "soft commitments," but no dry powder. Their whole strategy is to shop deals around and hope someone else steps up.

3. Fishing Expeditions

They're never going to invest. They want intel: competitor benchmarks, market dynamics, or your playbook. You're giving away your secrets for free.

In all three cases, the founder pays the price.

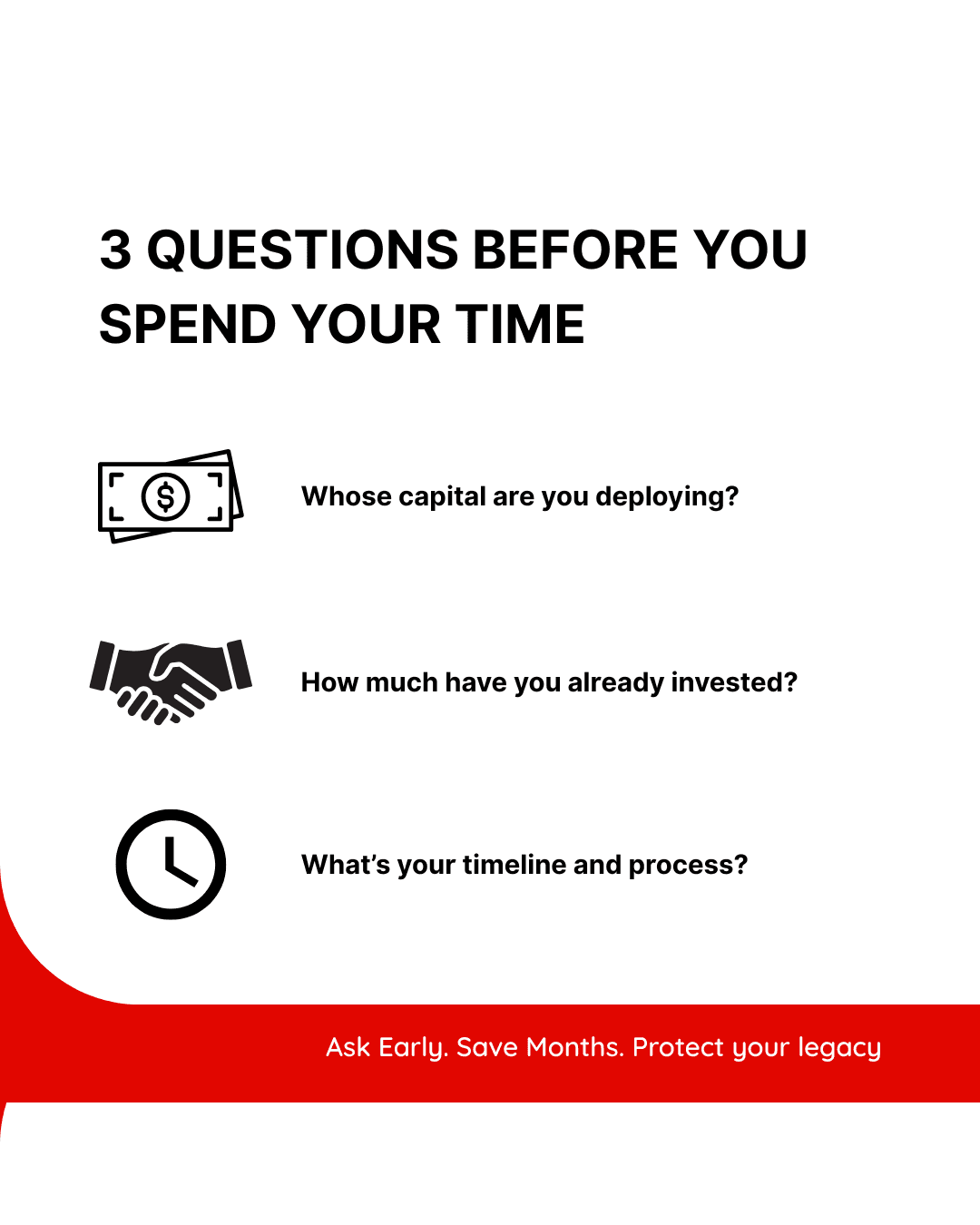

The Three Questions That Cut Through the Noise

Before you sign an NDA, share your data room, or clear your calendar, ask these upfront:

1. Whose capital are you deploying?

If they can't name actual LPs, family offices, or a fund with committed capital, it's not real.

2. How much have you already invested?

If the answer is zero, that means you are the experiment. Real investors have track records.

3. What's your timeline and process for a deal?

If the process is vague, expect drift. Real buyers run tight, repeatable processes with defined steps and deadlines.

You'll be surprised how quickly this filters the room. The ones who can't answer either ghost or get defensive. The ones who can are worth engaging.

Why This Matters

Every month spent chasing a fake buyer is a month not spent building your business, strengthening your leverage, or preparing for a real exit.

The risks go deeper than time:

- Team distraction: Word leaks, employees lose focus, and your best people start looking over their shoulders

- Market perception: Rumors of a potential sale can spook customers, suppliers, or even competitors

- Investor credibility: Real investors notice when you're "always in play." It raises questions about your discipline and focus

What starts as a promising introduction can quietly undermine the business you've built.

What You Should Do Instead

-

Vet first conversations as hard as they vet you. Treat your capital as scarce — because it is.

-

Control the process. Don't hand over your full playbook on a first call. Share only what is necessary until credibility is proven.

-

Signal strength. Share that you are working with advisors, have a defined process, and are speaking with multiple parties. Real buyers respect discipline; fake ones disappear.

-

Align with the right partners. Advisors who've been operators and investors can tell the difference between real capital and smoke. It's pattern recognition built over years.

Closing Thought

In this market, time is your scarcest resource. Don't spend it chasing ghosts. Real capital has a name, a checkbook, and a process. If you're not seeing those, you're not dealing with a buyer, you're dealing with a distraction.

The founders who win are the ones who spend their energy building leverage, not entertaining promises. The difference is worth millions.

Key Takeaways

- Most "interested buyers" don't actually have capital to deploy

- The lower middle market is particularly vulnerable to fake buyers

- Three simple questions can quickly filter out the noise

- Time spent chasing fake buyers has real opportunity costs

- Real capital has a name, a checkbook, and a process

Ready to Avoid These Mistakes?

If you're a business owner considering a transaction, don't make these costly errors.

Get started with our advisory services to ensure you maximize your transaction value.

If you're an investor looking for well-prepared acquisition targets, access our investor information to learn about our investment advisory services.

The difference between a successful transaction and a costly mistake often comes down to preparation. Don't let these common errors cost you millions.

Ready to Transform Your Business?

Don't let your life's work get undervalued. Get the strategic guidance you need to navigate M&A, capital raising, or growth through acquisition with confidence.

No sales pitch. Just honest advice from experienced M&A professionals.

Related Articles

Valuation Strategies for Tech Companies

Traditional valuation methods often fall short when assessing technology companies. We explore the specialized approaches that deliver accurate valuations.

Read More →Post-Merger Integration: The Critical First 100 Days

The deal is closed, but the real work begins. How to ensure successful integration and maximize value creation in the crucial first months.

Read More →